Home | Category: Muslim Education, Government and Finance

MUSLIM FINANCE

Faisal Islamic Bank ATM in Khartoum

Islamic finance is worth $700 billion worldwide according to Moody’s Investors Services as of 2008. The top 100 Islamic banks held assets totaling $580 billion in 2008, up from $350 billion in 2007 according to the annual report by Asian banker magazine.

Islamic bank accounts were estimated to be over $200 billion worldwide in 2007 by the Istanbul-based Islamic Finance Forum and is growing by 10 percent to 20 percent a year. Its growth have largely been fueled oil money from the Middle East and the large amount of money in Islamic financial instructions has also helped fuel a construction boom in the region.

Many still regard Muslim finance as a niche market in that many Muslims invest their money in products and services that do not comply with Sharia. Worldwide is still only accounts for 1 percent of the global finance market but some predict it may reach 12 percent by 2025.

Websites and Resources: Islam IslamOnline islamonline.net ; Institute for Social Policy and Understanding ispu.org; Islam.com islam.com ; Islamic City islamicity.com ; BBC article bbc.co.uk/religion/religions/islam ; University of Southern California Compendium of Muslim Texts web.archive.org ; Encyclopædia Britannica article on Islam britannica.com ; Islam at Project Gutenberg gutenberg.org ; Muslims: PBS Frontline documentary pbs.org frontline; Istanbul-based Islamic Finance Forum

RECOMMENDED BOOKS:

“Islamic Finance: Law, Economics, and Practice” by Mahmoud A. El-Gamal Amazon.com ;

“An Introduction to Islamic Finance” by Mufti Muhammad Taqi Usmani Amazon.com ;

“Heaven's Bankers: Inside the Hidden World of Islamic Finance” by Harris Irfan Amazon.com ;

“The Art of Islamic Banking and Finance: Tools and Techniques for Community-Based Banking” by Yahia Abdul-Rahman Amazon.com

History of Muslim Finance

Modern Islamic capitalism was created in the early 1960s in Egypt, with the introduction of savings accounts for Muslims. The first Islamic bank was only founded in 1975. Islamic finance only really started to gain attention after September 11th. Islamic finance was given a push by the September 11th attack and the invasion of Iraq, which forced the repatriation of funds to the Middle East ,where it was invested in Islamic funds.

Islamic Bank in Thailand

By the late 2000s Muslim finance had really taken off. Much of the growth then was fueled by the strengthening of economies in Asia’s Muslim countries and high oil prices which left countries in the oil-producing Middle East flush with cash and in need of places to dump it all. By this time, the Islamic finance sector had the credibility and experience to attract large investors. Emmanuel Daniel of Asian Banker told AFP: “Islamic finance has seen an incredible surge in popularity, based on stronger regulatory regimes and a better international understanding of its dynamics.”

Islamic financing was largely untouched by the sub-prime fiasco in 2008. It was given a boost after the global economic crisis in 2008-2009, prompted by the collapse of Lehman Brothers, when Middle Eastern investors decided to leave conventional investments and put their money in Islamic institutions. Advocates of the system promoted the system as a defense from speculators and economic swings. But as the Dubai meltdown im 2009 showed Islamic financing is not immune from global downturns, shady investments and speculation.

As of 2006 there were 300 Sharia complaint financial institutions. There are many more now. Because the investments are regarded as conservative and low risk they are starting to attract the attention of international investors. Islamic finance has yet to really catch in the United States but is growing and becoming a more common practice in Britain.

Zakat

The third pillar of Islam, zakat (almsgiving), is required of all Muslims. The faithful are expected to give in proportion to their wealth. In various historical periods, zakat assumed the status of a tithe that mosques collected and distributed for charitable purposes. In addition to zakat, Muslims are encouraged to make free-will gifts (sadaka , from the Arabic sadaqa ).*

Zakat generally involves giving away a certain percentage of one's income and savings to the poor.It is regarded as a form of worship and an expression of sympathy and a sharing in God's blessing. It has traditionally been practiced in association with Ramadan, when the rich traditionally held feasts for the poor, but today is very institutionalized and resembles paying taxes, with government and mosque bureaucracies collecting much of the money and dispensing it as a kind of welfare.

zakat slot at the Zaoula Moulay Idriss II in Fez, Morocco

According to the BBC: Zakat “is regarded as a type of worship and of self-purification. Zakat is the third Pillar of Islam. Zakat does not refer to charitable gifts given out of kindness or generosity, but to the systematic giving of 2.5% of one's wealth each year to benefit the poor. T he 2.5% rate only applies to cash, gold and silver, and commercial items. There are other rates for farm and mining produce, and for animals. [Source: BBC, September 8, 2009 |::|]

“The benefits of Zakat, apart from helping the poor, are as follows; 1) Obeying God; 2) Helping a person acknowledge that everything comes from God on loan and that we do not really own anything ourselves; 3) And since we cannot take anything with us when we die we need not cling to it; 4) Acknowledging that whether we are rich or poor is God's choice; 5) So we should help those he has chosen to make poor; 6) Learning self-discipline; 7) Freeing oneself from the love of possessions and greed; 8) Freeing oneself from the love of money; 9) Freeing oneself from love of oneself; 10 ) Behaving honestly” |::|

Zakat was originally a religious tax of 1 to 5 percent of a individuals earnings. It was an obligation often conjoined with prayer and was distinguished from the free will giving. Muslims regarded it not as a tax but rather as a “loan” made to God — in addition to taxes to authorities — specifically to help the poor and needy. These days Sunnis are expected to hand over 2.5 percent of their income; Shiites, 10 percent. In some Arab and Muslim countries, zakat replaces taxes.

In most places and most countries individuals are left on their own to make their own charitable contributions with no civil penalties of they don’t pay up. Donations come in the form of cash, jewels, cars and even kidneys. Rich Gulf Arabs have donated millions of dollars. Telethons in the rich gulf states have amassed more than a $100 million in a few hours. In the old days slaves and prisoners were sometimes freed as a zakat gesture.

Sunnah on Charity

There are about 700 verses in the Qur’an the refer to zakat. Among them is: "O ye who believe! Give of the good things which ye have earned" Zakat shows a willingness to "purify" earthly wealth and take on social responsibility for the Muslim community. Providing debt relief and helping strangers are both considered forms of zakat.

The Sunnahs are the practices and examples drawn from the Prophet Muhammad's life. Along with the Hadiths they are the most important texts in Islam after the Qur’an. They must adhere to a strict chain of narration that ensures their authenticity, taking into account factors such as the character of people in the chain and continuity in narration. Reports that fail to meet such criteria are disregarded.

meat for the poor during Kurban bayrum The Sunnah reads: “When God created the earth it began to shake and tremble; then God created mountains, and put them upon the earth, and the land became firm and fixed; and the angels were astonished at the hardness of the hills, and said, "O God, is there anything of thy creation harder than hills?" and God said, "Yes, water is harder than the hills, because it breaketh them." Then the angel said, "O Lord, is there anything of thy creation harder than water?" He said, "Yes, wind overcometh water: it does agitate it and put it in motion." They said, "O our Lord! is there anything of thy creation harder than wind?" He said, "Yes, the children of Adam giving alms: those who give with their right hand, and conceal from their left, overcome all." [Source: Charles F. Horne, ed., The Sacred Books and Early Literature of the East, (New York: Parke, Austin, & Lipscomb, 1917), Vol. VI: Medieval Arabia, pp. 11-32]

“The liberal man is near the pleasure of God and is near paradise, which he shall enter into, and is near the hearts of men as a friend, and he is distant from hell; but the niggard is far from God's pleasure and from paradise, and far from the hearts of men, and near the fire; and verily a liberal ignorant man is more beloved by God than a niggardly worshiper.

“A man's giving in alms one piece of silver in his lifetime is better for him than giving one hundred when about to die. Think not that any good act is contemptible, though it be but your brother's coming to you with an open countenance and good humor.

“There is alms for a man's every joint, every day in which the sun riseth; doing justice between two people is alms; and assisting a man upon his beast, and with his baggage, is alms; and pure words, for which are rewards; and answering a questioner with mildness is alms, and every step which is made toward prayer is alms, and removing that which is an inconvenience to man, such as stones and thorns, is alms.

“The people of the Prophet's house killed a goat, and the Prophet said, "What remaineth of it?" They said, "Nothing but the shoulder; for they have sent the whole to the poor and neighbors, except a shoulder which remaineth." The Prophet said, "Nay, it is the whole goat that remaineth except its shoulder: that remaineth which they have given away, the rewards of which will be eternal, and what remaineth in the house is fleeting." Feed the hungry, visit the sick, and free the captive if he be unjustly bound.

Sunnah on Labor and Profit

The Sunnah reads: “Verily the best things which ye eat are those which ye earn yourselves or which your children earn. Verily it is better for one of you to take a rope and bring a bundle of wood upon his back and sell it, in which case God guards his honor, than to beg of people, whether they give him or not; if they do not give him, his reputation suffers and he returns disappointed; and if they give him, it is worse than that, for it layeth him under obligations. [Source: Charles F. Horne, ed., The Sacred Books and Early Literature of the East, (New York: Parke, Austin, & Lipscomb, 1917), Vol. VI: Medieval Arabia, pp. 11-32]

“A man came to the Prophet, begging of him something, and the Prophet said, "Have you nothing at home?" He said, "Yes, there is a large carpet, with one part of which I cover myself, and spread the other, and there is a wooden cup in which I drink water." Then the Prophet said, "Bring me the carpet and the cup." And the man brought them, and the Prophet took them in his hand, and said, "Who will buy them?" A man said, "I will take them at one silver piece." He said, "Who will give more?" This he repeated twice or thrice. Another man said, "I will take them for two pieces of silver." Then the Prophet gave the carpet and cup to that man, and took the two pieces of silver, and gave them to the helper, and said, "Buy food with one of these pieces, and give it to your family, that they may make it their sustenance for a few days; and buy a hatchet with the other piece and bring it to me." And the man brought it; and the Prophet put a handle to it with his own hands, and then said, "Go, cut wood, and sell it, and let me not see you for fifteen days." Then the man went cutting wood, and selling it; and he came to the Prophet, when verily he had got ten pieces of silver, and he bought a garment with part of it, and food with part. Then the Prophet said, "This cutting and selling of wood, and making your livelihood by it, is better for you than coming on the day of resurrection with black marks on your face."

“Acts of begging are scratches and wounds by which a man wounds his own face; then he who wishes to guard his face from scratches and wounds must not beg, unless that a man asks from his prince, or in an affair in which there is no remedy.

“The Prophet hath cursed ten persons on account of wine: one, the first extractor of the juice of the grape for others; the second, for himself; the third, the drinker of it; the fourth, the bearer of it; the fifth, the person to whom it is brought; the sixth, the waiter; the seventh, the seller of it; the eighth, the eater of its price; the ninth, the buyer of it; the tenth, that person who hath purchased it for another.

“Merchants shall be raised up liars on the day of resurrection, except he who abstains from that which is unlawful, and does not swear falsely, but speaketh true in the price of his goods. The taker of interest and the giver of it, and the writer of its papers and the witness to it, are equal in crime. The holder of a monopoly is a sinner and offender. The bringers of grain to the city to sell at a cheap rate gain immense advantage by it, and he who keepeth back grain in order to sell at a high rate is cursed.

“He who desireth that God should redeem him from the sorrows and difficulties of the day of resurrection must delay in calling on poor debtors, or forgive the debt in part or whole. A martyr shall be pardoned every fault but debt. Whosoever has a thing with which to discharge a debt, and refuseth to do it, it is right to dishonor and punish him. A bier was brought to the Prophet, to say prayers over it. He said, "Hath he left any debts?" They said, "Yes." He said, "Hath he left anything to discharge them?" They said, "No." The Prophet said, "Say ye prayers over him; I shall not." Give the laborer his wage before his perspiration be dry.

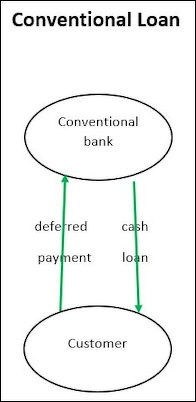

Muslim Law, Interest and Usury

Profit-taking and interest are against Islamic Law. Many Muslim countries don't have conventional banks with interest-bearing bank accounts or other financial services taken for granted in the West. The Qur’an explicitly forbids “ riba”, an Arabic word that has been defined as usury, on the grounds that it was used by moneylenders to take advantage of the poor. The Qur’an says “Whatever you give as riba so that it might bring increase through the wealth of other people will bring you know increase with Allah.”

According to Qur’an: “Allah hath blighted usury.” Muhammad said: "Allah curses one who devours usury, the one who pays it, the one who writes the contact between them and the two witnesses of the contract." The Qur’an also states: "God permitteth trading and forbiddeth interest...If you do not give up (interest), then be warned of war against God and his messenger; and if ye repent; then ye shall have your principal (without interest); neither ye wrong nor be wronged."

As it is generally understood, conservative Muslims are not supposed lend money, borrow money or take a mortgage or car loan if the paying of interest is involved. They are not supposed to invest the stock market or even use credit cards because credit card companies charge interest. In Muslim countries, mosques and public treasuries organize interest-free loans and emphasize "mutual aid and cooperation.”

Islamic Banks

Some countries like Saudi Arabia have no conventional banks. Bahrain, Dubai, Riyadh and London are major Islamic banking centers. The biggest banks—Dubai Islamic Bank, Kuwait Finance House and Saudi Arabia’s al-Rajhi Bank—are in the Persian Gulf.

As of 2003, Islamic banking was operating in 200 financial institutions in 23 countries that controlled more than $200 billion in deposits. The market was growing at a rate of 15 percent a year. [Source: International Herald Tribune]

According to Asian banking magazine seven of the top bans and 12 out of the 100 biggest Islamic banks were Iranian but Saudi Arabian ones were the most profitable, with Saudi Arabia’s Al Rajhi Bank with the highest net income ($1.74 trillion). Iranian banks accounted for 40 percent of the total assets of the top 100 banks, with the United Arab Emirates, Malaysia, Saudi Arabia and Kuwait banks accounting for another 40 percent.

Outside the Middle East, the only Islamic banks with significant assets were in Malaysia and Bangladesh. Asian and North African Islamic banks are still relatively small. Two Britain-based banks made it int the top 100. Indonesia, the world’s largest Muslim country, had only two banks in the top 100, while Pakistan had three and Singapore, Malaysia and Brunei each had one.

Islamic Banking

Banks are expected to be “ halal” ("acceptable") and in accordance with “ Sharia” (Islamic law). The basic tenants of Muslim baking are that transactions must be free of interest and there must be no “ gharar”, which roughly translates to uncertainty or deception.

What would normally be categorized as interest in regular banking is generally viewed as rent, dividends or profit sharing in Islamic banking. For example interest in a savings account may be expressed as a share of the bank’s profit, Islamic banks regard depositors as partners. Their money is invested and they share in the profits, and theoretically, its losses too. One Islamic bank representative told the Washington Post he could not think of one example in which an investor lost money and said money tends to be put in low risk investments,’ A customer at a an Islamic bank said he generally received about returns of about four percent. “Usually it’s a very low risk or very low gain. But I’m happy with it,” he said.

The whole concept of Islamic banking and investment—offering dividends and profit-sharing rather than interest—didn’t evolve until the 1970s, when the first Islamic bank opened in Dubai. Up until then many Muslims with money were paying and collecting interest like everyone else and not thinking twice about it.

There is a necessity clause in the Qur’an which states that money acquired through usury can be accepted as savings, with the interest donated to charity. To get around the ban against interest some banks distributed the money too the poor but not all they earned. Before Islamic banks became big, many wealthy, devout Muslims kept their money in cash and non-interest bearing bank accounts at commercial banks. Customers at regular banks signed forms waiving their right to interest.

Islamic banks offer Visa cards, access to automatic teller machines and telephone and Interent banking. Their credit cards generally require owners to pay off the full balance every month. Late credit card payments attract no interest but repeat offenders have their cards taken away. Some also have women’s branches from which men are barred from entering.

www.islamic-banking.com

Concept of Islamic Banking

Islamic banking is based on the ideas of transactions, partnerships and shared risk, profit and loss rather than interest and making money. There should be a minimum of uncertainty because uncertainty is associated with gambling. In Islamic, gambling is banned along with alcohol, pornography and pork.

Money in banks is not looked at in terms of being a source of investments in interest-earning accounts but rather as a source of funds used to facilitate transactions in which money is earned from the exchange of goods. Parties involved in a transaction are expected to equally share the risk. This means that a bank and a client invest in a risk-sharing arrangement rather than having a bank lend money to the client and earn interest. This means that there is a greater risk of losing the principal and there is no fixed rate of return.

The Muslim attitude about money is different from views about it in the West. The belief is that money just can’t sit around generating more money. To grow it has to be invested in productive enterprises. Amr al-Faisal Dar of al-Mal al-Islami financial services, told the Washington Post, “In Islamic finance you cannot make money out of thin air. Our dealings have to be tied to actual economic activity like an asset or a service. You can not make money off of money. You have to have a building that was actually purchased, a service actually rendered, or good that was actually sold.”

One Islamic banker told the International Herald Tribune, "The whole idea is a fundamental approach to money. Money can not make more money. Money must be used productively. And risk has to be shared...Very often people tend to forget that Islamic banking is really part of the global ethical investment." Majed al-Refaie of the Bahrain-based Unicorn Investment Bank, told the Washington Post, “The beauty of Islamic banking and the reason it can be used as a replacement for the current market is that you only promise what you own. Islamic banks are not protected if the economy goes down—they suffer—but you don’t lose your shirt.

Regulations and Potential Problems with Islamic Banking

Dubai Islamic Bank

In the west banks have to satisfy government regulators. In Islamic financing they have to satisfy religious regulators known as the Sharia board. The Kuala-Lumpur-based Islamic Financial Services Board (IFSB) is a body that makes sure transactions are consistent with Islamic jurisprudence. Islamic banks appoint a Sharia (Islamic law) board which makes sure that all activities and transactions are in accordance with Islamic principals. Bank accounts that yield what amounts to interest do so in accordance with Islamic rules by financing trade transactions with trade companies as opposed to investing in promising companies or buying real estate that increases in value.

But everything isn't necessarily hunky dory with the system. There have been charges of corruption and bad investments and insinuations that money could be used to fund terrorism. September 11th caused some institutions to be investigated for ties with terrorist organizations and some been sued by families of 9/11 victims. The wife of slain journalist Daniel Pearl sued an Islamic bank for its alleged involvement in the death of her husband.

Rodeny Wilson, an expert of Islamic financing at Durham University, told U.S. News and World Report, “Most Gulf banks do have fairly sophisticated monitoring systems in place” to ferret out money-laundering, terrorism, or other abuses. Wilson also noted that the 9/11 terrorists used western banks to finance their operations.

Different interpretations by Sharia scholars has led to confusion about what is permissible and what isn’t. As a rule the scholars that oversee banking in Southeast Asia are seen as more permissive that those in the Persian Gulf. The Islamic bond market fell by 50 percent in 2008 after a Bahrain-based group of Islamic scholars decreed that most of the bonds were not compatible with Sharia law.

There is some disagreement among Muslim scholar as to what all this means in practice. For example, it is not exactly clear whether Sharia prohibitions bans all interest, any interest, or only excessive interest. The Grand Mufti, the second-highest ranking Muslim cleric and the holder a seat in the Egyptian government, issued a fatwa stating that earning interest in a bank account was permissible. His edict angered conservatives and defied an Islamic position which had stood for centuries.

Islamic Investments

Islamic investors are not allowed to invest in companies that are “ haram” (forbidden). These include those that lend money, receive interest, are linked with taboos or social vice such as gambling, arm manufacturing, pornography, music, tobacco, alcohol drinking, or pork eating.

Investments also must comply with the concept of shared risk. Gharar means that financial dealings must be clearly defined and understood by the parties involved. This excludes complex financial arrangements such as futures and options.

Muslims have traditionally invested in real estate, trade, financing or small businesses. One Kuwaiti banker told the International Herald Tribune, "The vast majority of Islamic investments do not appear on bank balance sheets as the money is generally invested privately in the businesses of friends and relatives."

Types of Islamic Investments

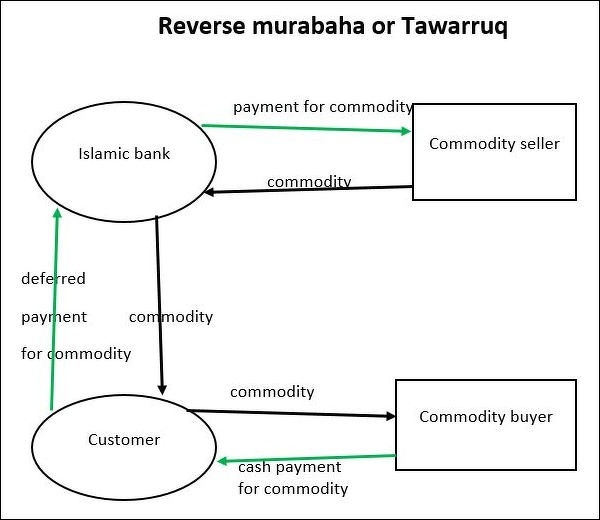

The most common Islamic investment product is a “ Murabaha” —a type of trade finance contract where an asset is sold by a bank from a seller to a buyer on terms providing a fixed level of profit of the seller. Used to buy thing things such as cars or equipment, it is like a cash deposit, highly liquid with a similar level of return. In most cases a bank buys the asset and transfers ownership to a client, who usually provides collateral and makes deferred payments to the bank equaling the original sum plus an additional amount.

Many times this means a lease agreement is made that is similar to that used by people who lease a car in the United States: a finance company buys a car and allows the customer to drive it in exchange for monthly payments over a fixed period. When the term is over, the customer can buy the car at the market price or enter into another lease. On a larger scale an Islamic bank may help a borrower by buying a commodity (like iron for example), then sell the commodity to a borrower with an arrangement in which the borrower pays off the sale in monthly installments, with the borrower then selling the commodity itself, and using that money for purchases as if it were a loan. The transitions are all worked in advance and done early simultaneously so market price fluctuations have minimal affect.

Islamic banks are using principal of sale and leaseback schemes to finance purchases of airplanes worth hundred of millions of dollars. The central bank of Malaysia conducts Islamic financial business in international currencies to help increase investment from abroad. Among the large projects financed by Islamic investments is the so-called $27 billion economic city near Jeddah in Saudi Arabia.

Islamic Financial Schemes

There are Islamic leasing funds (similar to “ Murabaha” except assets are leased rather sold) and Islamic equity funds, which invest mainly in stocks of oil, utilities and health-care companies. As of 2003, Islamic equity funds controlled $5 billion in assets.

Other kinds of Islamic financial schemes include “ takaful” (Islamic insurance), “ ijara” (Islamic leasing contracts), “ istisna’a” (a kind of financing used in construction and trade in which banks pays a client and receive the back the original sum plus a percentage of the profit), “mudarabaih” (a profit-sharing agreement at an agreed ratio rather than pre-defined rate of return), “ musharaka” (a bank-client agreement in which both contribute capital and share profits at an agreed ratio rather pre-defined rate of return), “salam” (a contract for deferred purchase of a commodity in which payment is immediate) and “ suluks” (short term, liquid, asset-backed, tradeable Treasury instruments). There is even talk of establishing Islamic hedge funds. [Source: International Herald Tribune]

Takaful is based on the Qur’anic principal of mutual assistance in which participants are insured as well as unsired. The system is set up to avoid payments of interest. The market for Islamic insurance was expected to rise fivefold from around $2.8 billion i 2007 to $14 billion in 2015.

Islamic house buying mortgages offered in the United States. They are essentially partnerships based on a lease-purchase agreement that resembles conventional financing. Under the terms, a home buyer and finance company buy the property together (with, say, the company putting up 80 percent of money and the home buyer, 20 percent). A system of monthly payments is worked out that repays the company its capital and pays a fair-market rent on the property based on the percentage of money paid up front (if the finance company pays 80 percent of house, it initially receives 80 percent of the rent). As time goes buy the home buyer repays the capital paid by finance company and takes on an increasingly large ownership stake and pays less rent. When the homeowner pays all the capital the house is his and the rent payments stop.

“Approved” Stocks

Stocks and bonds are sold by Islamic financial institutions but only under certain terms. They have to be linked with a physical asset and can’t be bought and sold by speculators. Bond traders have to have a Standard and Poor rating to reduce risk. Some banks invent in stocks from "approved" companies. The earnings from shares are all directed into dividends, which are regarded as money earned from transactions.

Stocks that do not receive an "approved" ranking do things like lend money, receive interest, or are some how linked with taboos or social vice such as gambling, pornography, gambling, arm manufacturing, alcohol drinking, or pork eating.

Several companies including Dow Jones offer Islamic funds and investing indexes. The Dow Jones Islamic Index was established in 1999. The Dow Jones Islamic Fund, which invests in Sharia-compliant companies was funded the next year. The Islamic Market Index monitors over 660 Sharia-complaint companies, including Microsoft, Coca-Cola, and BP Amaco. Hotel chains and airlines are omitted because they serve alcohol.

Islamic Bonds

“Sukuk” (“Islamic bonds”) have become popular among corporations and governments as a way to raise money. About $97.3 billion worth of sukuk had been issued according to Moody’s Investors Services as of late 2007. The market grew from $3 billion in 2001 to $20 billion in 2007. The market for Islamic bonds was expected to reach $200 billion by 2010. The Islamic bond market doubled each year from 2004 to 2007 but then fell by 50 percent in 2008 after a Bahrain-based group of Islamic scholars decreed that most of the bonds were not compatible with Sharia law.

Unlike typical corporate bonds in which companies pay a fixed rate of interest to investors Islamic bonds derive their investment return from the assets used to back them. The concept is not all that different from a revenue bond that a city uses to finance a municipal project.

Issuing sukuk has to be done for the purpose of goods trading or project financing and usually is linked with “murabaha”, is similar to credit installment services, and “ijara”, the leasing of buildings and machinery. As of the late 2000s, the majority of sukuk was issued in Malaysia which was trying to promote itself as a center of Islamic financing. Islamic bonds have also been issued by Japan, the U.K. and the German state of Saxony. The London Stock Exchange began selling sukus in 2008. Eighteen were trading there by the end of 2008.

Islamic mutual funds stay away from financial services companies because they engage in riba but have no problems with oil companies because environmental and social issues are not a concern. As a result of these investments many Islamic mutual funds performed well when energy prices were high and financial service companies were suffering as a result of the sub prime crisis. Moreover, at that time companies involved in tobacco, liquor, gambling and arms sales were not doing very well either. And because of this the majority of the investors in some Islamic funds are non-Muslims.

Some funds encourage investors to think about how to give 2.5 percent of their wealth to the “zakat” tax. One fund manager told Newsweek, “You can amass as much as you want. You’re purifying your wealth by paying that tax.”

Islamic Loans and Mortgages

An “ijara” mortgage is a sale and leaseback transaction where the bank or a special-purpose vehicle owns the property for the period of the mortgage and “rents” it to buyers. HSBC, Citigroup and Lloyds TSB offer Islamic mortgages — home loans that comply with the ban on offering interest. Islamic Bank of Britain offers Sharia-complaint savings accounts.

Rather than lend money to a home buyer and collect interest on it, an Islamic banks buys the property and then leases it to the buyer for the duration of the loan. The clients pays a set amount to the bank each month and then at the end obtains full ownership. The payments are structured to include the cost of the property plus a predetermined profit-margin for the bank.

A computer engineer who said he borrowed from an Islamic bank to buy a building said that even when he is late making a payment he does not have to pay cumulative interest or a larger sum than the one agreed on. The engineer said it can be harder getting a loan from an Islamic bank than a conventional one because Islamic banks have structured lending rules and require borrowers to have higher incomes and put up larger collateral.

The system attracts some non-Muslim investors. Tariq Makhance, an Islamic banker at the Chicago office of Unicorn Investment, told the Washington Post, “banks feels safer and more comfortable with us because we put down more money, more equity. We are not allowed to borrow with very little down.”

Foreign Banks and Islamic Finance

Western banks such as Citibank, BNP Paribas, Deutche Bank, HSBC and the Swiss bank UBS all offer Islamic banking services. Accounting firms like Ernst & Young and Price-Waterhouse Coopers have developed Islamic accounting and auditing practices. In the United States, Freddie Mac and other American financing companies offer mortgage loans that comply with Islamic law.

HSBC has been in the Middle East since 1889 when the Shah of Iran gave it a banking license to open up the London-based Imperial Bank of Persia. Among global banks it is regarded having a “dominant position” in the Middle East.

Citibank has been in the Middle East since the 1950s. It offers Islamic financing in Central Asia as a means of attracting foreign investments from the Middle East to the region. In the mid 2000s, UBS opened a separate Islamic private bank in Dubai for wealthy clients. In 2006, the British government launched Sharia-compliant children’s education accounts. In 2006, AIG, the world’s largest insurer at that time, opened a Bahrain-based unit offering policies that complied with Islamic laws and principals.

Image Sources: Wikimedia Commons

Text Sources: Internet Islamic History Sourcebook: sourcebooks.fordham.edu ; Arab News, Jeddah; “Islam, a Short History” by Karen Armstrong; “A History of the Arab Peoples” by Albert Hourani (Faber and Faber, 1991); “World Religions” edited by Geoffrey Parrinder (Facts on File Publications, New York); “Encyclopedia of the World’s Religions” edited by R.C. Zaehner (Barnes & Noble Books, 1959); Metropolitan Museum of Art, Encyclopedia.com, National Geographic, BBC, New York Times, Washington Post, Los Angeles Times, Smithsonian magazine, The Guardian, Al Jazeera, The New Yorker, Time, Newsweek, Reuters, Associated Press, AFP, Library of Congress and various books and other publications.

Last updated April 2024